In the hustle and bustle of running your business, record keeping often falls by the wayside. Most small business owners put corporate record keeping somewhere below “eating gravel” on their to-do list. The corporation’s minute book is often never even created in the first place, let alone kept up to date, even though the consequences of failing maintain one can be severe, and incredibly expensive.

Why do I have to?

Incorporating brings a lot of benefits – limited liability and tax being the biggest – but also comes with increased responsibility. The government has said, through the laws it has passed, that if you want the good stuff you’ve got to deal with the additional administration that comes with it. Whether you incorporated federally, or in Ontario, you must prepare and maintain corporate records. Trust me, it’s worth a little hassle and expense now to avoid greater hassle and expense later.

So what if I don’t?

Worst case scenario, your corporation could be found guilty of an offence under corporate law, and liable for a fine of up to $25,000.

Aside from the official penalty, there’s a great deal of business risk involved if your books are non-existent or out of date. I’ve often found myself playing CSI: Minute Book, going back several years to piece together the company’s history. It can take a fair bit of time and money to get it all figured out – neither of which small businesses have in spades.

There are a few common situations where your minute book will be in demand:

- If you’re selling part or all of your company, the buyer will want to see the books as part of their due diligence – so they know exactly what they’re buying. Poor record keeping can drive the purchase price down, and the delay to get your books in order could put the whole sale at risk.

- Most banks and other lenders will want to see your minute book before lending money to your business. They want to know that its affairs are in order, and the people they’re dealing with are authorized to act for the corporation.

- Your accountant may want to see the minute book in preparing its tax returns. Without it, she’ll be forced to make assumptions on how to characterize the income, and may end up mis-reporting.

- The Customs and Revenue Agency is entitled to inspect your books, and may do so as part of an audit of your personal taxes or the corporation’s taxes. This is more common if you’re paying yourself by dividends, or you’ve lent money to the company. The CRA could characterize money coming to you as personal income, tax the hell out of it AND deny the corporation the right to deduct it as an expense. Talk about lose-lose…

- Shareholders, as owners of the company, have a legal right to inspect the minute book to know what decisions are being made.

OK then, what is it?

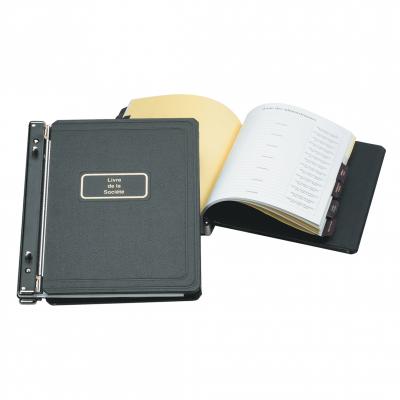

A minute book is really just a binder that holds the important documents of your corporation.

If a lawyer incorporated your business, they probably provided you with a minute book to start. If not, then you’ll have to prepare one yourself, including:

- Certificate of Incorporation;

- Articles of Incorporation;

- By-Laws;

- Consents to Act as Directors;

- Director and shareholder resolutions

- Minutes of director and shareholder seetings;

- Registers of the officers and directors;

- Register showing the number of shares issued of each class of shares;

- Record of the debt obligations of the corporation;

- Stated Capital – the number of issued and outstanding shares;

- Documents filed with government departments;

- Share certificates, if used; and

- The corporate seal, if used.

Then you’ve got to maintain the minute book, by keeping it up to date as the corporation does its business, including:

- Resolutions from the annual meetings of shareholders and directors;

- Electing directors each year;

- Appointing accountants or auditors for each year;

- Approving financial statements;

- Records of loans to or from shareholders

- Declared dividends;

- Management bonuses paid;

- Issuance or transfer of shares;

- Changes in directors or officers;

- Changes to how the corporation is run;

Can’t you just do it for me?

What’s tedious and boring to you is an adrenaline-fuelled rollercoaster ride of awesomeness for me. OK, maybe that’s a little extreme, but I’m happy to take the tedium off of your hands. I can’t emphasize enough that it’s far far far far cheaper, easier, and less stressful to stay on top of this stuff than it is to go back and piece it together in an emergency – like when an investor or potential buyer wants to inspect your books.

Some clients like me to hang on to the record book and keep it updated when things change. Others want to keep it themselves, and have me send them the updates when they make changes. Either way, this is one of those things that you shouldn’t waste your time doing…

Hey, you just read this blog,

and this is crazy,

but here’s my website,

so call me, maybe.

Mike Hook

Intrepid Lawyer

https://intrepidlaw.ca

@MikeHookLaw

Jim

Fantastic blog post and as startup business this was very helpful in putting together our minute book for the bank loan officer’s to review!